Les nouveautés incontournables en automobile

Les voitures familiales

Les véhicules pour les familles nombreuses connaissent aussi des évolutions technologiques.

Les voitures de sport

Les automobiles de caractère intéressent chaque personne sans distinction de genre.

Les voitures anciennes

Le cercle des voitures rétro s’agrandit avec le nombre de passionnés.

Location de voiture

Trouver une voiture ou louer la vôtre

La solution apporte des bénéfices à chaque partie. Avec la méthode actuelle des plateformes de location, un locataire peut trouver une offre de location correspondant à son budget, pour une voiture précise.

1er site de location de voiture entre particuliers

Les professionnels en matière de location de voiture inondent désormais la toile, avec des offres pour toutes les catégories de clientèle, et pour toutes les bourses. Vous pouvez cependant en trouver certaines, avec des modalités simples, et qui proposent l’offre de location de voiture entre particuliers.

Ce genre de plateforme vous permet de vous défaire de nombreuses formalités. Ici, le principe est simple, puisque l’affaire se déroule d’un particulier à un autre. Le premier obtient un marché de location, le second trouve un véhicule pour un besoin spécifique. En conclusion, les deux parties y gagnent.

Concessions automobiles

Achat d’une voiture chez un concessionnaire

Acheter une voiture neuve s’effectue généralement chez un concessionnaire. L’avantage de ce principe figure dans les services annexes, en plus de l’obtention d’une garantie. Le professionnel peut aider pour les documents administratifs.

Le concessionnaire peut aussi vous vendre une voiture 4×4 d’occasion, qui a été totalement remise en état.

Nouvelles technologies

Les innovations technologiques de l’automobile

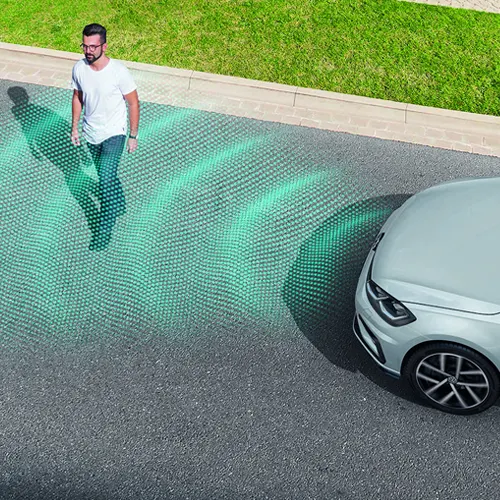

Un détecteurde piétons

Parmi les gadgets utiles à produire en série, celui-ci s’avère être utile pour rester prudent, malgré les éventuels moments d’inattention.

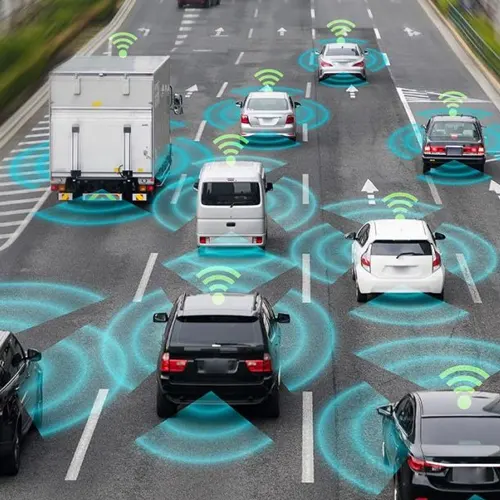

La communication entre voitures

Les constructeurs de voiture et autres acteurs concernés par la sécurité routière étudient ce système, censé limiter le nombre d’accidents.

La conduitesemi-autonome

Le pilotage automatique ne peut réellement s’appliquer sur route. Le système semi-autonome s’en rapproche néanmoins, avec des fonctionnalités plutôt efficaces.

Conseils & entretien Auto

Entretien de sa voiture au quotidien

Qui veut aller loin ménage sa monture, dit-on. Ce principe s’applique ni plus ni moins à votre voiture. En effet, vous apprenez à la base qu’il faut vérifier le liquide de refroidissement, la pression des pneus, ou l’état des optiques de phare, quotidiennement.

Mais l’entretien concerne aussi le respect des changements de fluide et des pièces d’usure, suivant les recommandations du constructeur. Une vidange régulière favorise la longévité de votre moteur. Un contrôle du système de freinage vous permettra d’éviter les accidents. Engagez un professionnel, au besoin.